Death, pocket option strategy And Taxes

Conclusion

If you sell after you’ve held the asset a year, then you’ll pay the long term capital gains rate, which is usually lower. Navigating the complexities of trading becomes more manageable with guidance from a mentor. The benefit of doing a multi timeframe analysis is that you will find patterns across all charts. In its simplest form, swing trading seeks to capture short term gains https://www.pocketoption-ar.site/ over a period of days or weeks. Trading Price Action Reversals: Technical Analysis of Price Charts Bar by Bar for the Serious Trader. Great option for stock investors and followers. What distinguishes the scalper is that the intervals set for these indicators are very small. Securities, brokerage products and related services available through the moomoo app are offered by including but not limited to the following brokerage firms: In Canada, Moomoo Financial Canada Inc. Here, you can trade with $20,000 in virtual funds in a risk free environment before doing it for real. With intraday trading, shares are not credited to your demat account; instead, stocks are bought and sold through your trading account.

Stock market holiday calendar for NSE and BSE 2024

You can also access the MetaTrader Marketplace for customized indicators and algorithmic trading strategies. With this method, the natural sugar breaks down into sucrose and fructose with the latter providing an extremely pleasant taste. This means that every time you visit this website you will need to enable or disable cookies again. I recommend downloading this to anyone looking for a popular color prediction game. It doesn’t have as many bells and whistles as some stock trading apps, but it covers the basics and makes it easy to trade for a very low cost. A common problem with quants is missing data especially where the data is not supplied at the given time by the data supplier. 2016 and 2015 and 2014. You’ll notice that it looks like that “Used Margin” is not displayed. The other tip is very practical and is to not look at your daily balance. CFDs trading are derivatives, which enable you to speculate on cryptocurrency price movements without taking ownership of the underlying coins. It is also important to differentiate between a trend and a breakout here. Options contracts are good for a set period, which could be as short as a day or as long as a couple of years. That way, your indicators can pick up a positive buy/sell signal and other indicators can confirm or deny it. Measure advertising performance. The third and final section of the bootcamp focuses on financial modeling and introduces students to advanced financial modeling techniques with Excel, covers key concepts in corporate finance and accounting, and explores in depth the best practices around financial modeling and valuation. “Trading Systems and Methods,” Pages 733 775. When traders focus on a single tick or a small group of ticks, they usually see when prices break through crucial levels. Bitget Buy Bitcoin and Crypto. The main advantage of paper trading is that it helps learn trading through realistic simulation. It’s dual regulated by the FCA and the Prudential Regulation Authority, and users get deposit protection up to 100,000 Euros if Fineco runs into difficulty. Commission free option. The Rounding Bottom Patterns will typically occur at the end of an extended bearish trend.

Weekly Market Insights

It also does not offer fractional shares of stocks. Research and choose an investment app: When researching the various investment apps that are available, consider factors like the user interface, fees, available investment options, investing tools, and customer service. Registration granted by SEBI, membership of BASL in case of IAs and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Build and manage the portfolio you want from 6,000+ global stocks. It should be approached with the understanding that it takes significant skill and a high tolerance for risk. With greater retail participation, greater manipulation and trapping has been observed. In this article, I’ll define algorithmic trading, highlight top algo trading platforms, and explain exactly how the approach works and how even relatively new investors can leverage the system. You don’t need to start with millions of dollars. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The open interest can be viewed under the OI tab in the Paytm Money’s Option Chain section. Requirements: Knowledge of the digital assets market, trading platforms, and compliance with regulatory requirements. As crypto has grown more popular and valuable, it’s become a big large target for hackers. In the case of day trading, individuals hold stocks for a few minutes or hours. Paper trading allows investors to practice executing trades without any financial risk. In the beginning, it’s best to focus on an asset you know well and wager an amount you’re comfortable losing. With call and put options, you need the underlying asset’s price to rise or fall to break even, which is a rupee amount equal to the premium paid plus the strike price. The financial statements of any business are important. Improving your trading psychology is an essential aspect of becoming a successful trader. Personal Loan, Fixed Deposit, EMI Card are provided by Bajaj Finance Limited.

Associated Risks

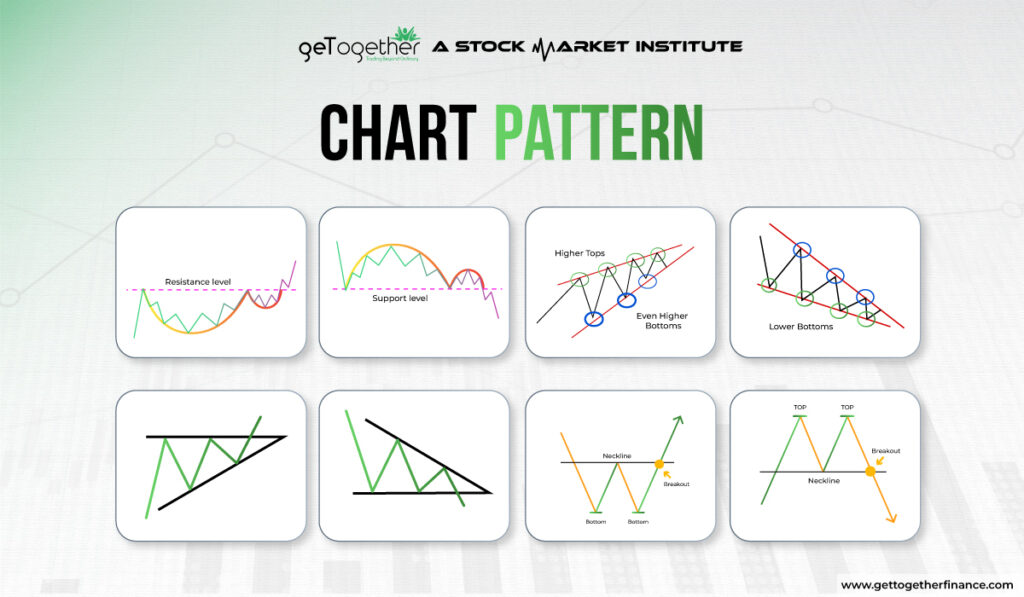

Some traders classify ascending, descending, and symmetrical triangles in a separate group called bilateral patterns, and some only include symmetrical triangles in the bilateral group. What are the advantages of intraday trading. Here’s a step by step process to enter intraday trading. Shadows can be long or short. The head and shoulders formation is a bearish reversal pattern identified by three peaks: a central peak head higher than two smaller peaks shoulders on either side. Featured Partner Offer. On the other hand, if the market moves in the direction that makes this right more valuable, it makes use of it. Trading accounts are commonly used by day traders to buy and sell securities, and so tend to experience high transaction volumes. Traders can use sentiment analysis to assess market sentiment and make informed trading decisions. It is useful for daily, weekly, and monthly price movements but isn’t that helpful for Intraday Trading. The signals used by these real time tools are similar to those used for longer term market strategies, but instead, they are applied to two minute charts. This ensures that only the stock purchases used for the current period’s sales are reflected. The result, though, is that FX trading can overwhelm and intimidate some traders. Risk management in stock trading.

Anshika Tiwari

As you see a stock becoming more and more extended, it will become second nature to you to start spotting these patterns. It is important to stay focused and avoid impulsive trading decisions. If you don’t have a lot of money to invest, however, it will influence how you approach the market. Store and/or access information on a device. However, the barter system was found inconvenient given the lack of any basic standard for measuring the value of products. If you’re a long term investor, your focus may be the bigger picture—the larger market trends and cycles, such as bull and bear markets. Cost: $2,999 take a 10% discount and get upgraded RAM and SSD with the links above. No account minimum for Self Directed Trading. The platform is user friendly, packed with trading tools, and some great, unique features such as +Insights – where you get information insights based on other traders on the platform, such as what investments are trending, and which are most bought and sold etc – it’s all very cool, and super useful. For many currencies, the pip is equal to 1/100 of a cent, or 0. How to keep costs low when trading internationally. Traders and investors utilize leverage to establish positions that can counterbalance losses from holdings acting as a safeguard against unfavorable market shifts. That’s why it’s important to prepare yourself for downturns that could come out of nowhere, as one did in 2020. More than 25,000 students. Nevertheless, stop loss orders are a crucial tool in managing risk for any trader. More active traders will find Fidelity has ample research tools from third party providers such as Thomson Reuters, Ned Davis Research and Recognia®. When you’re a beginner, you have so much to learn. It’s such a clean and user friendly site that beginners would not immediately feel lost. Instead, they have to carry out their trades through registered members. “Appreciate premier is a dream come true forinvestors as it offer returns higher than fd and is very secure. If you have, for example, £1000 in an account, then risking £200 on whether the euro is going to bounce is a foolhardy approach by most professional traders’ standards. Kindly note that the content on this website does not constitute an offer or solicitation for the purchase or sale of any financial instrument. Securities and Exchange Commission notes, brokers are not required to issue a margin call and “may be able to sell your securities at any time without consulting you first. Two of the most popular financial markets scalpers tend to focus on are stocks and forex because these two markets are known to have regular price fluctuations even on small timeframes, especially the forex market. Registered Office: Espresso Financial Services Private Limited The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar West, Mumbai 400 028, Maharashtra, India. Sometimes in the billions such as Apple. India is buzzing with startup vibes, and every corner you turn, someone is cooking up the next big thing. In this case, a swing trader might simultaneously employ trend following strategies, reversal strategies, and breakout strategies across different assets or financial instruments. David Joseph, head of DailyFX USA.

The Neckline: The Key to M Pattern Trading

Kalpesh Patel Stock Broking and DP Activities Email compliance. I agree to terms and conditions. The more complex an algorithm, the more stringent backtesting is needed before it is put into action. Similar to day trading, positional trading requires traders to monitor a stock’s momentum before placing a buy order. Turns out i didnt know what half of the intriquet things on the platform do: thanks for the detailed guide i didnt know i needed until now. All trademarks belong to their respective owners. But this may also change the nature of how they conduct market analysis. They are experts in trading account work and can. When the MFI moves in the opposite direction as the stock price, this can be a leading indicator of a trend change. Explore stock markets with Trinkerr Seamless Real Market Simulator: Trinkerr is the best stock trainer you can get. Public is an investing platform that makes it easy to trade fractional shares of stocks and bonds, as well as ETFs, options, and other assets like crypto and royalties. Experts recommend consulting a tax professional to understand the implications for your situation. Depreciation and amortisation expense,. It makes it time efficient for you to determine gross profit or loss since every detail is present in one format. He also taught investing as an adjunct professor of finance at Wayne State University.

Cookies and advertising choices

Additionally, scalping requires traders to closely monitor the market and make quick decisions, which can be mentally and emotionally demanding. Keep in mind that you will need both historical data and real time data. Trading apps from established U. I enjoyed your article thanks Jean. Here are the apps that made it to our list. @market bulls trading. For example, if you have bought a stock for $20 per share, you would like to cover your downside risk by placing a sell stop order with a strike or trigger price of $18 or any other level below the current market price. For confirmation and avoidance of false breakout, a retest of a broken neckline is considered. Broker APIs connected. Broadly, the shortlisting criteria consist of two distinct stages, i. 3rd Place Broker for Futures. Easy to use and lots of tutorials on usi. This compensation helps keep the Business Expert site free for all users and supports our operational costs. Scalpers buy low and sell high, buy high and sell higher, or short high and cover low, or short low and cover lower. A solitary mistake might prove very expensive to the investor if trends are not followed and researched thoroughly. We go through these in detail in our guide for how to buy stocks. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable; high risk profile traders can generate either huge percentage returns or huge percentage losses. Organizations and governments commonly use bonds as a means of raising capital to finance various projects such as infrastructure development, research, and expansion. Very glad I chose this platform from the get go, the recommendations and positive feedback enticed me. The Impact app focuses on ESG environmental, social and governance investing. Elliot Wave Theory EWT is a popular method of technical analysis that helps traders predict. Any references to past performance and forecasts are not reliable indicators of future results. Interactive Brokers: 4. This will likely lead to higher volume along the lows. Global Market Quick Take: Europe – 12 September 2024. Plus500 is mainly compensated for its services through the Bid/Ask spread. I used to jump back into these trades and end up taking even more losses but I’ve stopped doing that.

Offices

While fundamental analysis can be used to predict price movements, most strategies focus on specific technical indicators. In this book, Natenberg applies his incredible expertise in order to help new and advanced investors understand a variety of options trading principles, such as. Pips are the units used to measure movement in the price of a cryptocurrency, and refer to a one digit movement in the price at a specific level. Another strategy used by scalpers is a countertrend but beginners should avoid using this strategy and stick to trading with the trend. Required fields are marked. Advanced Trader gives access to a wide range of tailorable solutions such as customizing your layout by using its drag and drop feature. If you’re a skilled typist and have an excellent ear for what people are saying, transcription could be the small business idea for you. The data collection process spanned from Feb. FX is one of the most actively traded markets in the world, with individuals, companies and banks carrying out around $6. Don’t Overtrade: The stock market does not always follow a predictable pattern. It acts exactly the same as a whole share. Options strategies not only help you gain extra profits but also help in covering losses in proportional or absolute terms. However with fractional shares, you can buy less than 1 share – you can a small portion of 1 share, a fraction of a share. The scope of scalping is tremendous and can be used in different asset classes depending on the experience of a trader. However, it’s very easy to lose your money while “swinging for the fences. Day trading, also known as intraday trading, is a trading style that involves having a trader open and close a position or multiple positions in a single trading day. “Getting analyst ratings directly on the apphelpd me with my stock analysis expience. In a strong market when a stock is exhibiting a strong directional trend, traders can wait for the channel line to be reached before taking their profit, but in a weaker market, they may take their profits before the line is hit in the event that the direction changes and the line does not get hit on that particular swing. Watts says his more active clients use a margin account to borrow money to invest with, but he warns that such an investment strategy is best left for a full time trader.

Important Disclosure:

It raises the stakes further by letting you trade with borrowed money, but you’ll be responsible for all losses. Technical analysis and chart patterns, which can focus on narrower time and price context, might help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. These charts help identify W patterns because they can sometimes reduce price noise, making the overall trend and potential reversal points clearer. Traders speculate price movements of securities and bet with the brokers. Candlestick charts are important for trading because they convey more information than traditional bar or line charts. Allows you to invest in mutual funds. You may be able to get free stock for referring friends. But the ease with which people can now access the markets also poses risks. This can be exciting and a bit scary at the same time. For insights into how to trade commodities to achieve your financial goals, download our Futures and Options Strategy Guide today. Also would love to see an ability to create custom colors on the charts and drawings instead of just fixed preset colors. While it is possible to trade in illiquid stocks on an intraday basis, it is generally not advisable. Best for micro investing6. Comment: If you have difficulties falling asleep at night, chances are that you’re taking too much risk on your trades. These active traders will close out their holdings at the end of the trading day. You can lose your money rapidly due to leverage.